Business Breakthroughs Await: Seize Your Copy of Our Coaching Blueprint

Discover proven methods, insider tips, and real-world case studies that have propelled businesses to new heights. Whether you're a seasoned entrepreneur seeking to refine your strategies or a budding business owner navigating the initial challenges, this blueprint is tailored to meet you where you are and guide you toward your goals.

📞Call Now: (305) 987-3053

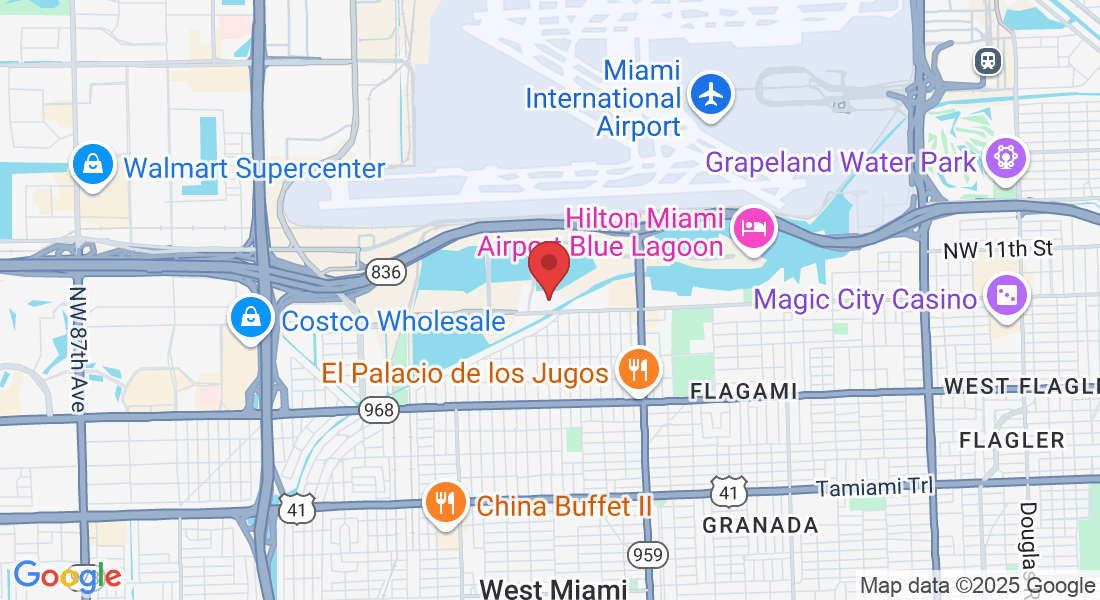

Retail Market Q1 2025

Dade and Broward Counties Market Report

As of the first quarter of 2025, the multifamily real estate market in Dade and Broward counties has exhibited strong performance, driven by a combination of population growth, increased rental demand, and a competitive investment landscape.

Vacancy Rates: The vacancy rates in both counties have remained relatively low, with Dade County at approximately 4.8% and Broward County at around 5.2%. These figures indicate a healthy demand for rental units, suggesting that the market is absorbing new inventory effectively.

Absorption Rates: The absorption rates have shown a positive trend, with approximately 1,500 units absorbed in Dade County and around 1,200 units in Broward County during the first quarter.

This reflects a robust demand for multifamily housing, particularly in urban and suburban areas that offer convenient access to amenities and employment centers.

Volume Sold: The volume of multifamily properties sold in the first quarter reached approximately $450 million across both counties. This figure underscores a strong investment climate, with several significant transactions contributing to the overall sales volume, driven by both institutional and private investors.

General Market Information: The multifamily market in Dade and Broward counties is characterized by a diverse range of housing options, from luxury high-rises to affordable housing developments. The ongoing influx of new residents, coupled with a strong job market, continues to drive demand for rental properties.

Additionally, developers are increasingly focusing on sustainability and community-oriented amenities to attract tenants. The trend towards remote work has also influenced preferences for larger living spaces and access to outdoor areas.

Overall, the multifamily real estate market in Dade and Broward counties remains robust, with positive indicators for continued growth and investment opportunities in the near future.

Markets at a glance:

Vacancy Rates:

Dade County: Approximately 4.8%

Broward County: Approximately 5.2%

Rent per Square Foot (SF):

Dade County: $2.50 per SF

Broward County: $2.35 per SF

Sale Price per Square Foot (SF):

Dade County: $300 per SF

Broward County: $275 per SF

These figures reflect the current market conditions and trends in the multifamily real estate sector for the specified counties.

Assistance Hours

Mon – Fri 9:00am – 4:00pm

Phone Number:

(305) 987-3053